Top 8 Best Invoice Factoring Companies 2022 Review

Content

They also offer a separate full-service trucking software called ProTransport that offers load management and tracking, two-way driver communication, and integrations with QuickBooks. We chose RTS Financial as our best invoice factoring company for trucking because the company specializes in trucking and the freight industry. The company provides credit reports, fuel card programs, and trucking-related software with a mobile app.

However, customers have noted some serious drawbacks with the company, especially as TAFS has grown. Unfortunately, customers report some negative experiences with eCapital. The company also has complex contracts and they can make it difficult to leave your contract. This difficulty is exacerbated by the poor communication and poor customer service that a number of users report. Some users also report having difficulties getting paid after their initial period with the company. Several customers are happy with eCapital, however, so it might still be a good fit for some owner-operators.

Best Factoring Companies for Trucking

The difference in what they pay you for the invoice, and what they collect from your customer, is their profit. One of the most important requirements for approval — and with some lenders, the only requirement — is having qualifying invoices. Factoring https://www.bookstime.com/ companies will consider the quality and quantity of your invoices when determining whether to approve your business for invoice factoring. The factoring company will evaluate the value of your invoices and the creditworthiness of your customers.

Paragon Financial Group is an established loan factoring company with over 25 years of experience in the industry. One of the immediate benefits of choosing Paragon Financial Group that jumps off the page is their incredibly low rates. These can vary based on the type of company owing the invoice and how long it has been outstanding but, generally, after all payments are complete, rates range between 0.9% and 2.5%. On their website, Paragon advertises their “soft touch” customer approach so that you can feel confident they will give your customers the same level of service as you would provide.

IFA Survey Lists Freight Factoring as Most Served Industry

The amount of funding that you’ll receive from this factoring company for trucking is actually based on your customer’s credit and not your business’s credit or history. If you’re on the lookout for reliable Canadian and US invoice factoring companies, you can’t go wrong with Riviera Finance. It is a non-recourse lender that will accept most of the invoices that other companies won’t and provide you with a factoring loan in a decent time frame. This is a perfect opportunity for small businesses that are trying to find their footing in the industry. If your main concern is finding a reliable lender with years of experience and standard industry rates, this one ticks all the boxes. AltLINE is a financial department of a well-known Alabama-based bank with decades of experience.

To qualify for their funding, you must be an entity that makes at least $ every year. While it’s been in the market for a relatively short time, it has increasingly built its customer base. Because of their familiarity with the industry their experience might be a good fit given that they provide a better rate than most companies out there. As opposed to other companies, you can’t apply for factoring on their website. You must contact their sales representative over the phone and tell them about your business and what you are looking for. Lendio is one of the most reputable small business loan marketplaces. By connecting borrowers to over 75 lenders, they are one of the best loan providers.

Breakout Capital Review

¹ Fortunately, invoice factoring can help you obtain fast access to capital by leveraging unpaid invoices. Many different industries use factoring, but the most common are staffing and trucking.

There are also 24 in-person locations across the country if you prefer to visit in person. She has more than 15 years of experience writing, editing, and managing business-focused content. She also co-authored a business book with FJ Management CEO Crystal Maggelet. Sarah is passionate about helping small-business owners reach sustained success. Levi King, who co-founded Lendio, founded Nav to help business owners become better-qualified applicants. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Factoring vs. other types of small business lending

If clients have to prepay, then theoretically there shouldn’t be a need to worry about delayed cash flow and unpaid invoices. The challenge with making this switch is that not all clients are willing to go along with a prepayment schedule.

Who bears interest in reverse factoring?

Typical interest rates for a vendor: factoring and reverse factoring. In factoring, the interest cost is borne by the supplier. The funder charges the factoring fee, which usually ranges from 1.15%-4.5%. Also, it issues advance payment at 70%-85%.

Dock David Treece is a contributor who has written extensively about business finance, including SBA loans and alternative lending. He previously worked as a financial advisor and registered investment invoice factoring advisor, as well as served on the FINRA Small Firm Advisory Board. Trusted by over 70,000 small businesses across the U.S., Fundbox is an example of a company that can help across multiple industries.

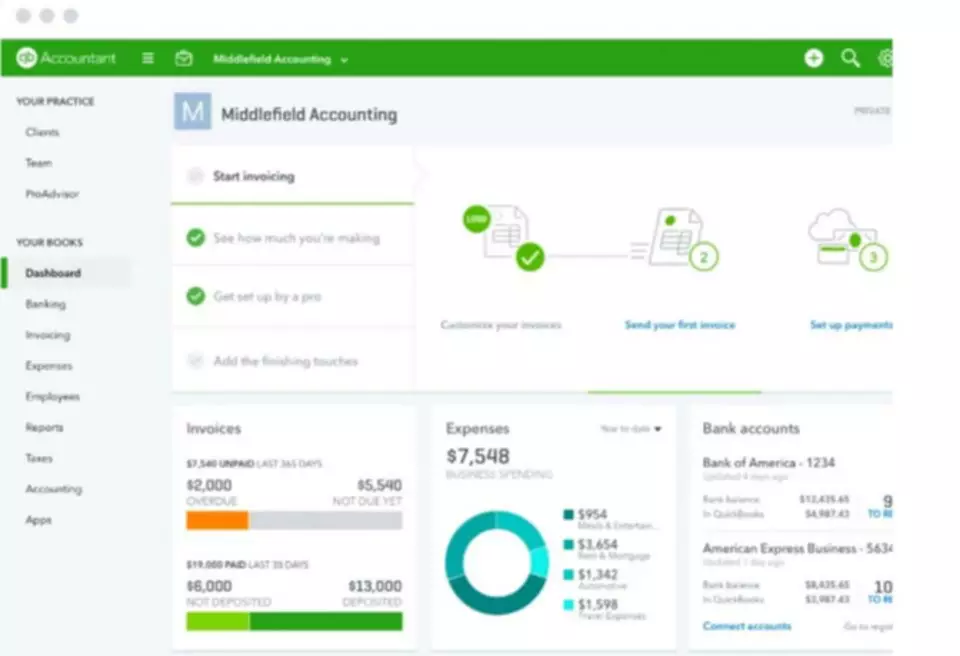

In addition to invoice factoring and accounts receivable financing, altLINE also has asset-based lending for businesses. In addition to invoice factoring, altLINE offers accounts receivable financing. While the two terms are often used interchangeably in the world of small business lending, they are not the same. Customers can make payments through Resolve’s white-labeled online payment portal via credit cards, ACH transfers, wire transfers, and even checks. And as the customer, you get an easy-to-use accounts receivables dashboard to see what is happening at any time. Plus Resolve integrates with QuickBooks, Magento, and WooCommerce.

Some factoring companies deal exclusively with trucking companies. Others include the trucking industry as one of many that they serve. One of the unique offerings for trucking companies is assistance with fuel payments. Freight factoring companies often offer discount fuel card programs that can be used at national or regional chains, and fuel advances in as little as one hour—a clear advantage for truckers. There are many different features to look for when choosing an invoicing factoring company. There are a number of reasons why you may want to consider partnering with an invoice factoring company. But when is the right time to make the shift from in-house invoice collection to an invoice factoring service?

The only potential concern with altLINE is that the company doesn’t offer a non-recourse factoring option. That means that if your client doesn’t end up paying the invoice, you will be liable for a chargeback. Non-recourse solutions sometimes come with higher fees in exchange for the factoring company’s added risk, and this may not be an issue for every business. If you’re looking for a recourse factoring solution, there’s no doubt that altLINE is a good choice. For 83 years, altLine The Southern Bank Company, a well-established lender, has provided small businesses with funding.

- The Southern Bank has been around for over 80 years so you know you’re in good hands.

- As mentioned, Payplant’s services are best-suited to small to midsize businesses — but a $1 million factoring cap means midsize businesses may eventually outgrow the company.

- Below you’ll find an in-depth review of each company that made my list.

- Many people use the terms “invoice financing” and “invoice factoring” interchangeably, but they operate very differently.

- Other than the collection process (i.e. assignment), both forms of financing are nearly identical.